November 25 Update

Making The News

1. Global Equity Markets

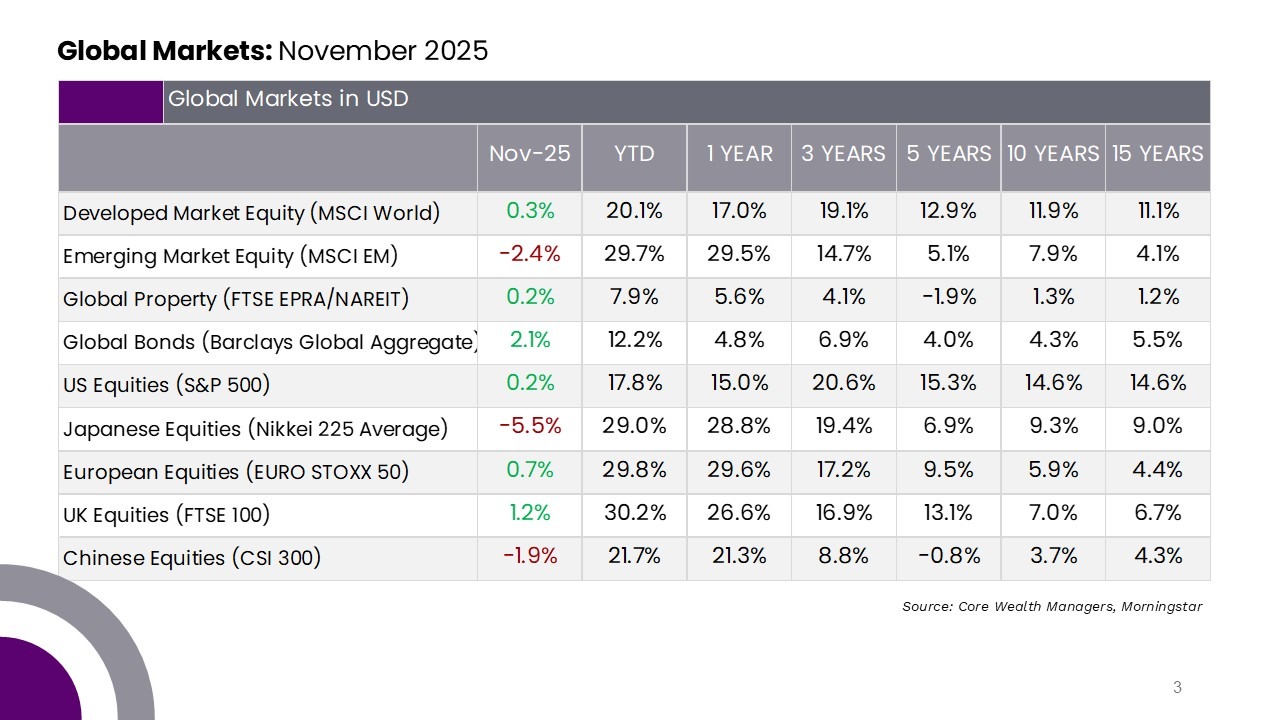

Developed market equities staged a late surge in November, enabling the MSCI World Index to close the month slightly higher (+0.3% MoM), marking the eighth consecutive month of gains and pushing global equity returns to +20.6% year to date. Momentum faded in the mega-cap technology space, with both the Nasdaq and Magnificent 7 indices ending the month in negative territory, despite Nvidia reporting strong earnings growth and upgrading its outlook – closing -13.0% lower for the month. Alphabet bucked the trend, climbing +14% as investor optimism grew around the latest release of its Gemini 3 AI platform. Healthcare emerged as the top-performing sector as investors shifted toward more defensive areas of the market. Emerging market equities lagged developed peers, with the MSCI EM Index falling -2.4% MoM, although it remains up a robust +30.4% for the year. Chinese stocks weighed most heavily on EM performance, with Alibaba declining -8.0% after reporting margin pressure in its core e-commerce operations.

2. Macro and Currency Developments

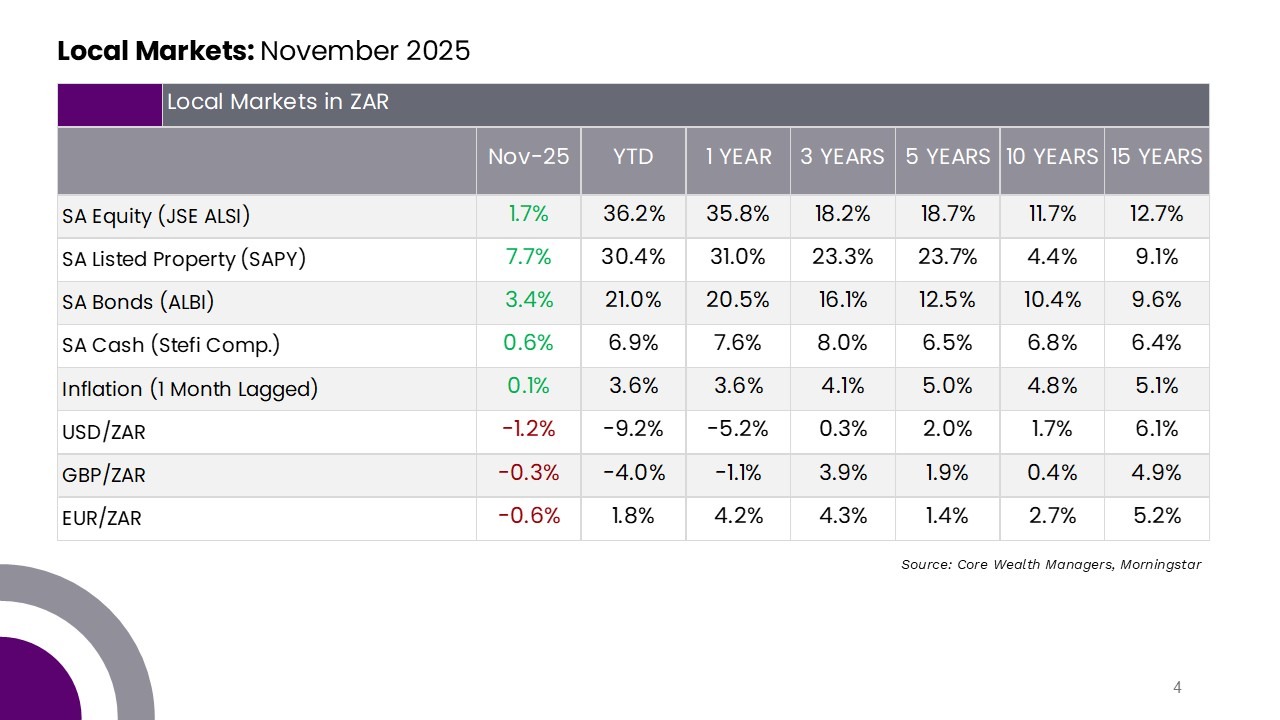

The US government ended its longest-ever shutdown after 43 days on 13 November, approving spending that will see it through to the end of January 2026, buying itself time to work out a longer-term funding plan. The government shutdown has kept government economists and statisticians on unpaid leave since the beginning of October, leaving investors without any meaningful economic data for the past couple of months. The absence of recent inflation and employment data gave investors limited information with which to change their assumptions about what the US Federal Reserve (Fed) might do at upcoming meetings. As a result, borrowing rates remained essentially unchanged during November. The US dollar weakened marginally against most major currency pairs (US Dollar Index -0.3% MoM).

3. Bond Market Breakout

Foreign investor appetite has been particularly strong in 2025, with net purchases of around R175 billion in South African bonds year-to-date, compared with R73 billion for the whole of 2024. The surge in demand helped drive the 10-year government yield down to +8.4%, its lowest level in more than eight years. Local bonds have now returned more than double the emerging-market average return in 2025, aided by economic reform momentum and interest-rate cuts. As sentiment towards SA gradually improves (e.g. removal from Greylist, S&P ratings upgrade etc.), global risk factors stand to be an increasing driver of future volatility.